.svg)

.svg)

.svg)

.svg)

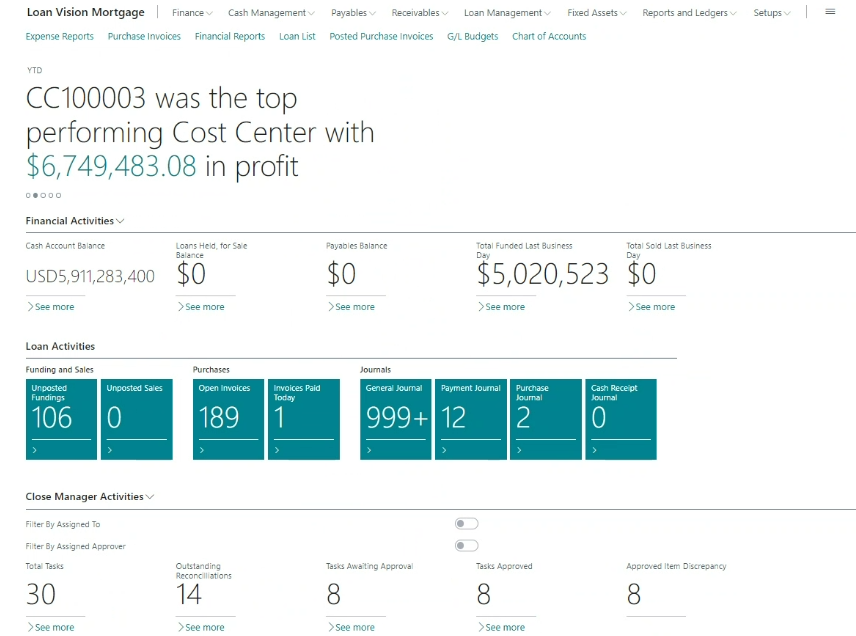

Navigate the intricate landscape of mortgage accounting with ease, leveraging

software that turns challenges into opportunities.

By streamlining accounting processes matched with real-time analytics, Loan Vision optimizes operations, significantly reducing

your cost-per-loan.

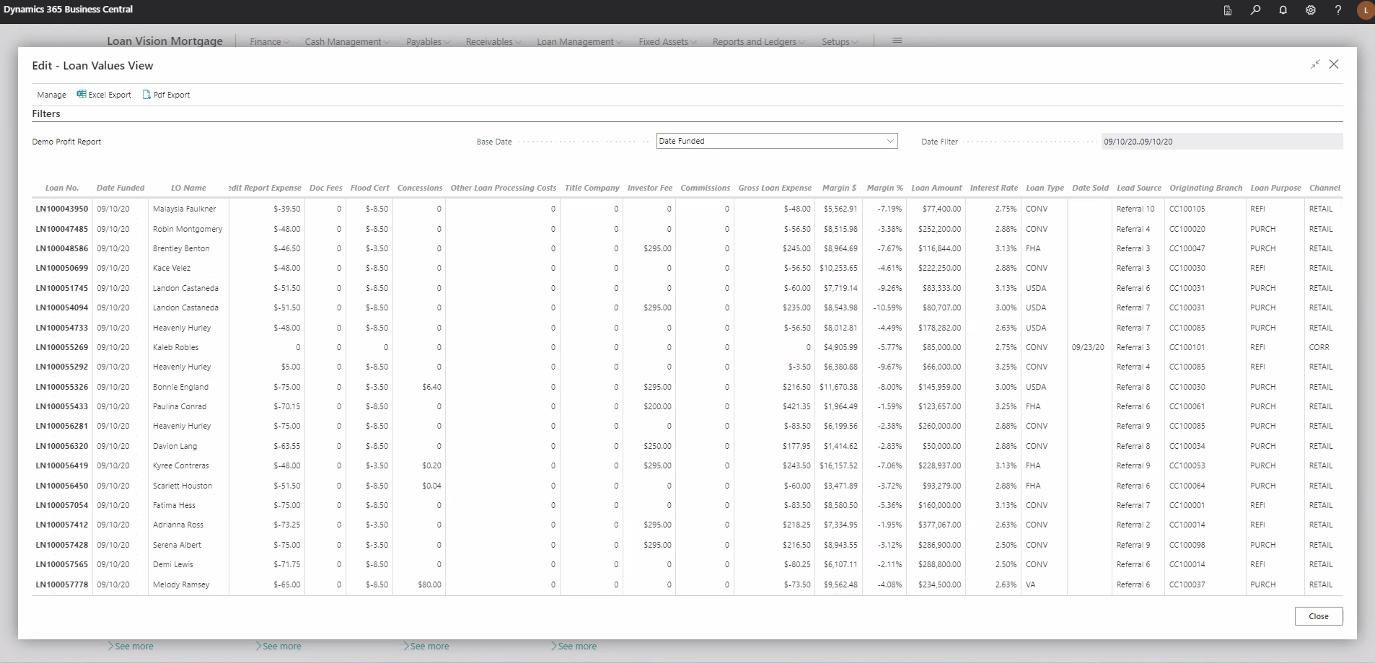

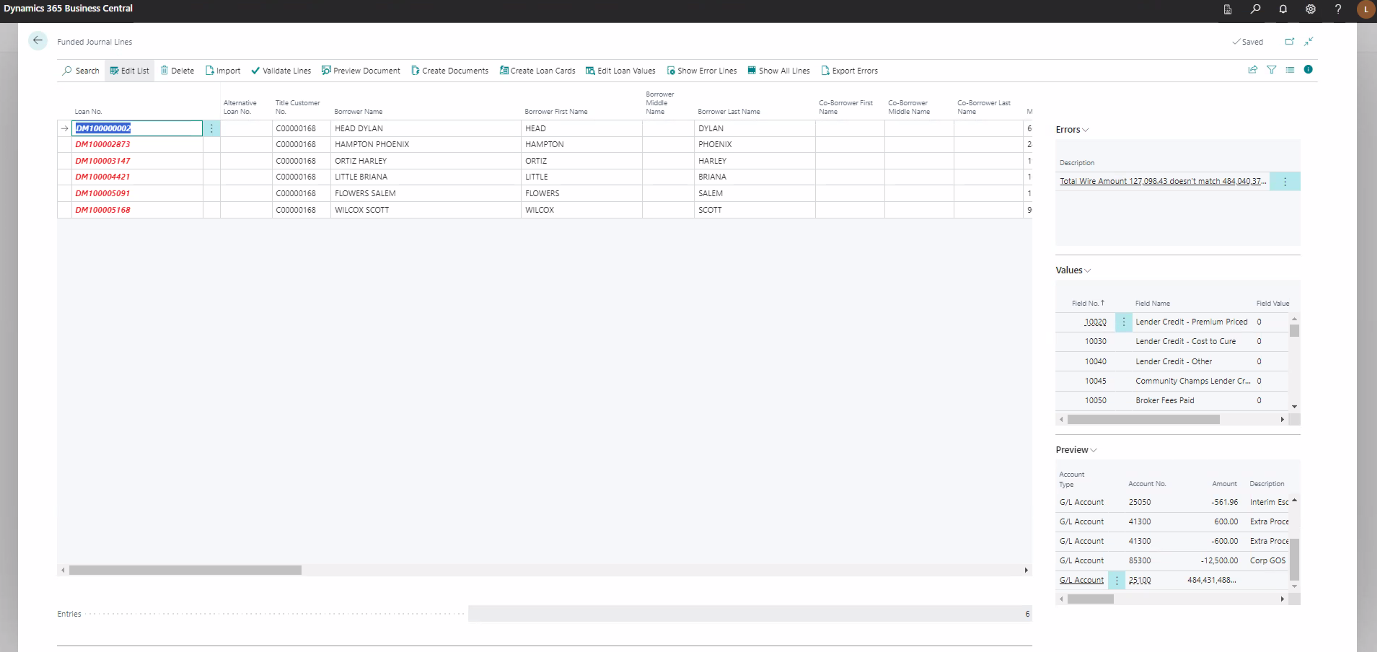

Automated features that validate loan-level data alongside direct integration from your LOS, Loan Vision reduces the likelihood of errors resulting in an increase in better efficiency and accuracy.

Detailed reports, charts, and analytics provide actionable insights into loan and key business performance to empower proper resource allocation.

Handle fluctuation challenges in real time as demand decreases or external forces impact the market, by getting deeper cuts of data to help you make sound decisions.